18.04.2021

Traffic Com Caboch: Based on raw numbers, Kapsch TrafficCom, Intelligent transportation systems provider, It expects revenue in fiscal year 2020/21 of approximately € 500 million. The operating result (EBIT) including negative special effects would be a loss of approximately € 124 million. The most relevant negative special effects are the EBIT impact of around € 139 million. Despite the significantly negative result, the equity ratio still stands at around 14%. As of March 31, 2021, Kapsch TrafficCom has held liquid funds in excess of € 100 million.

Kapsch TrafficCom: Weekly performance:

OMV: OMV’s Supervisory Board appointed OMV Martijn van Koten as a new executive board member responsible for the refining division of OMV Aktiengesellschaft. Martijn van Koten accepted the appointment.

OMV: Weekly performance:

(From 21 Austria Weekly https://www.boerse-social.com/21staustria (16/04/2021)

Image credit

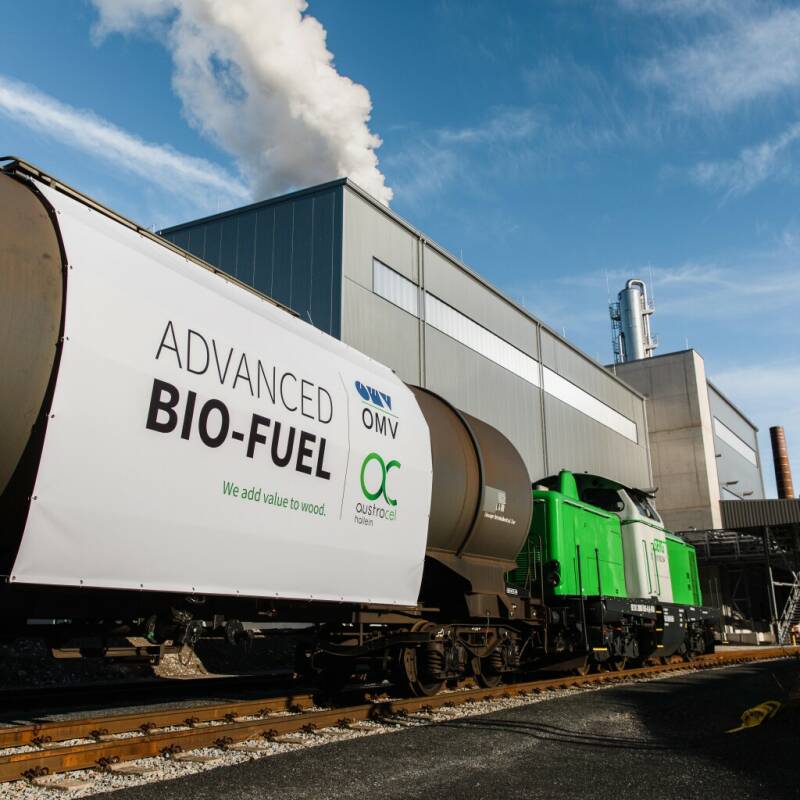

1. OMV and AustroCel started their long-term collaboration with the first successful delivery of a sample of bioethanol. The Hallein bioethanol plant is the world’s largest wood-based bioethanol plant; Image credit: AustroCel / Michael Schartner

Stocks on the radar:compositeAnd the Telecom AustriaAnd the RosenbauerAnd the FACCAnd the SBOAnd the Addiko BankAnd the voestalpineAnd the PalfingerAnd the ATX PrimeAnd the ImophenansAnd the AT&SAnd the AndritzAnd the frequentAnd the RosgexAnd the DO & COAnd the LinzingAnd the pornographicAnd the WolfordAnd the ZoomtobilAnd the SombertAnd the Athos Real EstateAnd the Environmental Technology in the SouthwestAnd the Perrier Mobility AGAnd the Linz Textile HoldingsAnd the Luggage box Oberbank AGAnd the BoagAnd the Actually, CAAnd the Erste GroupAnd the Kapsch TrafficComAnd the RBIAnd the Rather, S..

Random partner

Badir Bank

Badir Bank is one of the leading family-run investment banks in German speaking countries. The two main pillars of Badir Bank’s business model are market making and investment banking services. As a specialist in stock exchanges in Germany, Austria and Switzerland, Badir Bank trades in more than 800,000 financial instruments.

>> Visit another 62 partners boerse-social.com/partner

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

Wealthy families take more risks when it comes to money.

Salesforce and NVIDIA Form Strategic Collaboration to Drive AI Customer Innovation

Changing banks causes problems for customers