The US Federal Reserve is likely to raise interest rates by an unusually sharp rate on Wednesday. Experts expect an increase of 0.75 percentage points to a range of 2.25 to 2.50 percent.

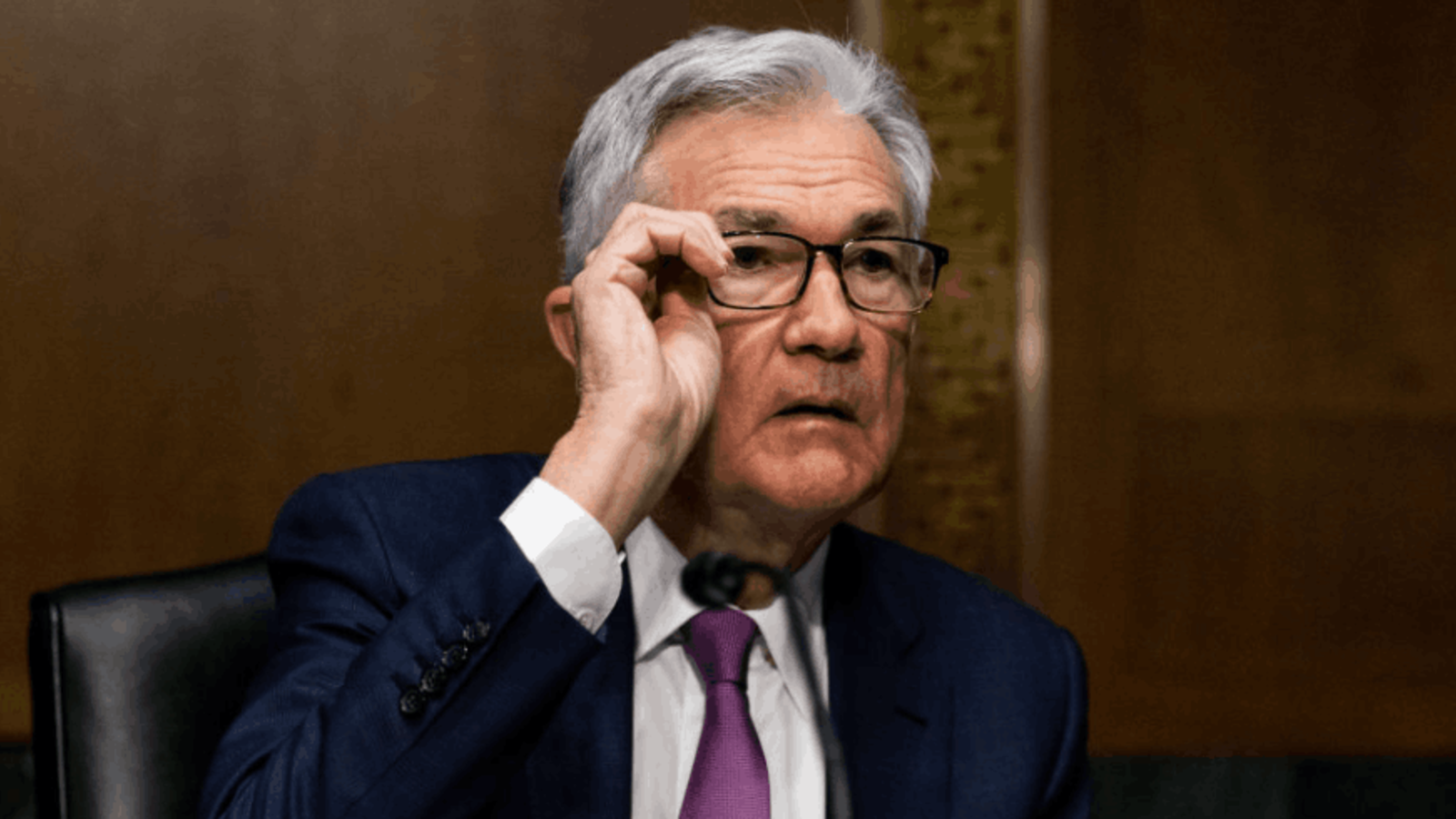

Despite fears of a recession, the US Federal Reserve faces another sharp rise in interest rates in its fight against high inflation. Currency watchdogs around Fed Chairman Jerome Powell have already raised the rate by 0.75 percentage points (75 basis points) in mid-June. According to many experts, another step of this unusual size should follow on Wednesday. The key interest rate ranges from 2.25 to 2.50 percent.

Can be increased by a whole percentage point

Even a more drastic increase of a full point cannot be ruled out. The Central Reserve should rush to quickly reach the so-called neutral interest rate level, at which the economy is no longer stimulated and inflation can finally die down.

“A rate hike of 75 basis points would bring the current monetary policy stance to what central bankers consider neutral,” said DWS economist Christian Sherman. Atlanta Fed District President Rafael Bostick recently spoke out against raising rates “very strongly.” Otherwise, the positive trends in the economy will weaken and the already considerable uncertainty will increase. Experts fear that too much tightening of monetary policy could cripple the economy.

US inflation is 9.1 percent

Constantly rising consumer prices reduce the purchasing power of American citizens. The inflation rate was last at 9.1 percent — the highest level since late 1981. Many experts and central bankers were caught off guard by the renewed surge in inflation. However, Fed Director Christopher Waller played down interest rate speculation. He stressed that the Fed would not break out its interest rate decision based on a single number, but analyze a range of data. Markets slightly overshot the target after worse-than-expected inflation data.

This was taken as a sign that the central bank is unlikely to dare to hike by a full percentage point. Commerzbank expert Bernd Weidensteiner also expects this not to happen: “With increasing signals of economic slowdown and calming inflation expectations, another big step is unlikely.”

“Amateur coffee fan. Travel guru. Subtly charming zombie maven. Incurable reader. Web fanatic.”

More Stories

Nicolas Loufrani: Young Londoners Design Afro Hair Emojis

US Election: Trump Vs. Harris – 2024 poll numbers in America

Börse Express – USA: Retail sales rise unexpectedly