The dry news is: American electric car startup Fisker has gone bankrupt. The situation can be likened to a patient who is kept alive only by machines. Bad news arrives all the time. But the final path to decommissioning the machines has not yet been followed.

Fisker opted for the aforementioned Chapter 11 procedure, which US automaker General Motors also used during the financial crisis. This means artificial survival. During these proceedings, the company can continue to operate and reorganize and reorganize itself under the court's temporary protection from creditors. The goal is to keep the company going – there is no guarantee of that.

This strategy worked at General Motors. Doubts are growing at Fisker. Because the electric startup, which promoted itself as a competitor to Tesla, never came close to achieving the goals it set for itself. It's a story of a big mistake, and a typical example of how an electric car company maneuvers against the wall.

This is how failure can be explained

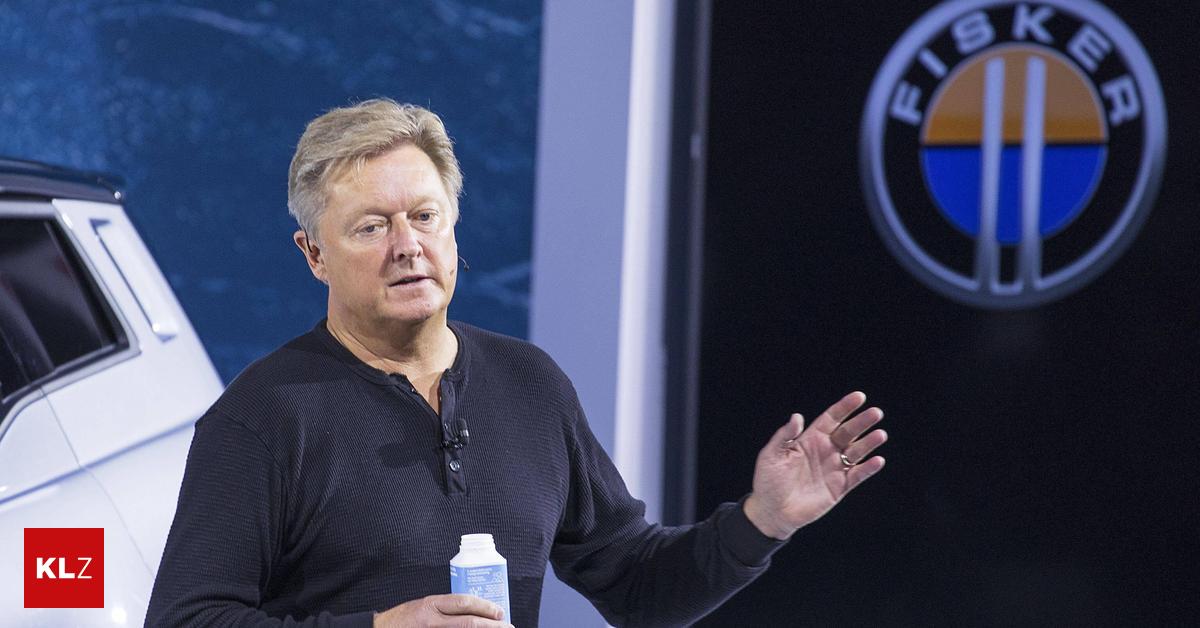

There are three moments that explain why Fisker failed. October 2022, just before production starts at Magna in Graz: Company president Henrik Fisker, who had previously gone bankrupt, talks about the 150,000 electric cars Magna wants to manufacture in 2024. However, problems appear in the background.

Also in Magna, people are wondering who will handle the international logistics of bringing the cars to the world. When asked, Fisker said in October 2022: No comment. Today we know that neither the logistics nor the dealer network are prepared accordingly. By the time the strategy was changed, it was already too late. Production is off to a slow start, including in 2023.

“I currently see no reason why we can't do this,” says Henrik Fisker. “We have more than 63,000 reservations, but software quality problems are spreading. Destructive test reports are emerging. Cars are not being delivered.” Fisker also stopped in December 2023 when Magna’s dismantling plans and figures became The company responded to questions like this: “We know that there are people spreading unfounded rumors to harm Fisker and our partner.”

The rearview mirror shows that the company imploded throughout the year, but in December 2023 it became clear that Fisker is just a castle in the air: they wanted to produce more than 40,000 electric cars and managed to produce 10,000 Ocean models.

The house of cards collapses

Critical questions will be answered with “no comment” in January 2024. Just like the rumor that you can't pay suppliers. “The company assumes that the company will generate income from the sale of existing series vehicles built in 2023 in the first half of 2024,” she wrote to investors. At the end there is also an ultimatum from Magna. You have a stake in Fisker, but the electric vehicle startup can't pay for services. Fisker's house of cards collapses.

The largest insolvency proceedings in Styria

Assets of between $500 million and $1 billion (€467 million to €934 million) are said to be offset by liabilities of between $100 million and $500 million. It seems manageable. But at the beginning of May, self-managed restructuring procedures had already begun in Graz through Fisker's Austrian subsidiary. Commitments amounted to 1.34 billion euros. This was the largest insolvency proceeding in Styria to date. Magna had to write off a three-figure sum of two million.

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

Wealthy families take more risks when it comes to money.

Salesforce and NVIDIA Form Strategic Collaboration to Drive AI Customer Innovation

Changing banks causes problems for customers