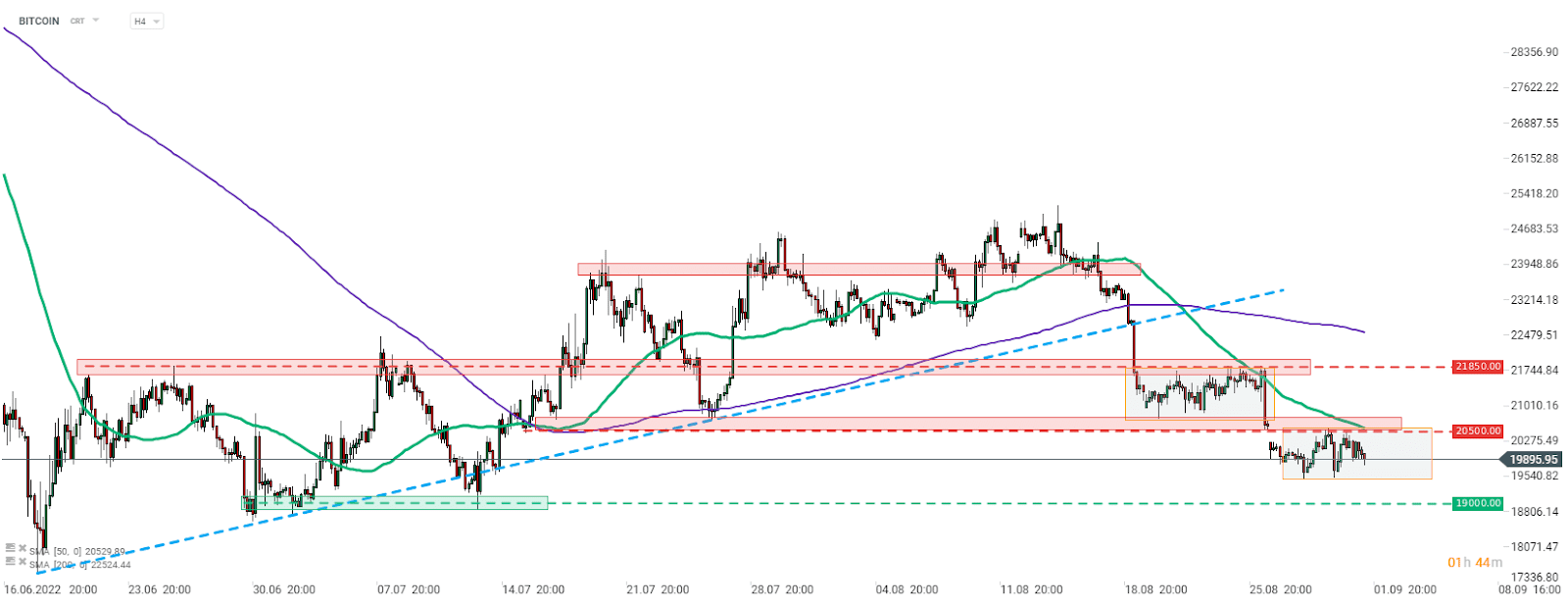

Sentiment in global markets took a turn for the worse after Powell’s speech at Jackson Hole last Friday. While this decline can be best seen in the stock markets, other assets – such as cryptocurrencies – are also suffering. After a brief relief yesterday, Bitcoin is making another attempt to make a decisive break below $20,000. The most popular cryptocurrency has been trading in a range between $19,500 and $20,500 over the past few days, which is roughly the same size as the previous bullish correction in the current bearish pulse that started on August 15, 2022. The limits of this range are important short-term levels to watch as That a break above the upper bound would, in theory at least, signal a potential uptrend reversal, while a break below the lower bound would indicate a deeper decline in the current short-term – the structure of a longer-term downtrend has been highlighted. Since the correlation between Bitcoin and the S&P 500 has been quite strong lately, it is safe to assume that tomorrow’s NFP report, which is expected to move the stock markets, will also affect the cryptocurrency.

Source: xStation 5

Disclosure in accordance with Section 80 WpHG for the purpose of potential conflict of interest

The author is currently not investing in the securities or assets discussed.

The authors of the publications compile this information at their own risk. The analyzes and opinions are not written with reference to anyone’s specific investment goals and needs. XTB publications commenting on specific situations in the financial markets and general statements made by XTB employees regarding financial marketsIt does not constitute, and should not be construed as, advice to clients of XTB. XTB is not responsible for any loss arising directly or indirectly from decisions made regarding the content of publications.

Risk Warning

CFDs are complex instruments and come with a high risk of losing money quickly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can take the high risk of losing your money. Investment success and past earnings do not guarantee future success. The content, newsletters and communications received from XTB do not constitute any action on the part of XTB.

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

Wealthy families take more risks when it comes to money.

Salesforce and NVIDIA Form Strategic Collaboration to Drive AI Customer Innovation

Changing banks causes problems for customers