XTB: US indices rebounded on Friday after a solid NFP report – December jobs data showed stronger-than-expected job growth and slower-than-expected wage growth. The Dow Jones, S&P 500, Nasdaq 100 and Russell 2000 all gained more than 2%.

– Good sentiment continued into the new week as indices also traded higher in the Asia Pacific. The Nikkei and S&P/ASX 200 were each up 0.6%, the Kospi 2.6% and the Nifty 50 1.5% higher. Indexes from China traded up 2%.

– A string of positive news from China is supporting Asian stock markets today. Funding for the real estate sector increased by 33% in December 2022 from a year earlier, according to Reuters. Chinese officials also announced that traffic during the Spring Festival will double to more than 2 billion passengers compared to 2022.

– DAX/DE30 futures point to a higher open in the European session today.

Riots broke out in Brazil as supporters of former President Bolsonaro stormed the Supreme Court building, Congress and the presidential palace. The riots have been condemned by President Lula, former President Bolsonaro and the leaders of democracies including Joe Biden and Emmanuel Macron.

– The cargo ship MV Glory ran aground in the Suez Canal this morning, but it is not yet clear to what extent traffic will be affected. A canal officials ship is trying to refloat it.

– The People’s Bank of China bought 30 tonnes of gold in December 2022, bringing China’s official gold reserves to 2,010 tonnes.

– A disruption in Iran’s pipeline network led to a 70% drop in natural gas exports to Turkey.

– Australian building permits fell 9%m/m in November (-1% expected).

– Cryptocurrencies are trading higher as sentiment has improved overall. Bitcoin is up 1.4%, Ethereum is up 3.1% and Litecoin is up 7.7%. Cardano is up 12%.

– Energy commodities traded higher on expectations of rising Chinese demand – Oil traded 1.5% higher as US natural gas prices rose 2.4%.

– Precious metals benefit from USD weakness. Gold was trading 0.6% higher, silver 0.8% higher and palladium 1.2% higher. Platinum is trading up 0.1%.

– AUD and NZD were the best performing major currencies, while safe havens – USD, JPY and CHF – were the biggest laggards.

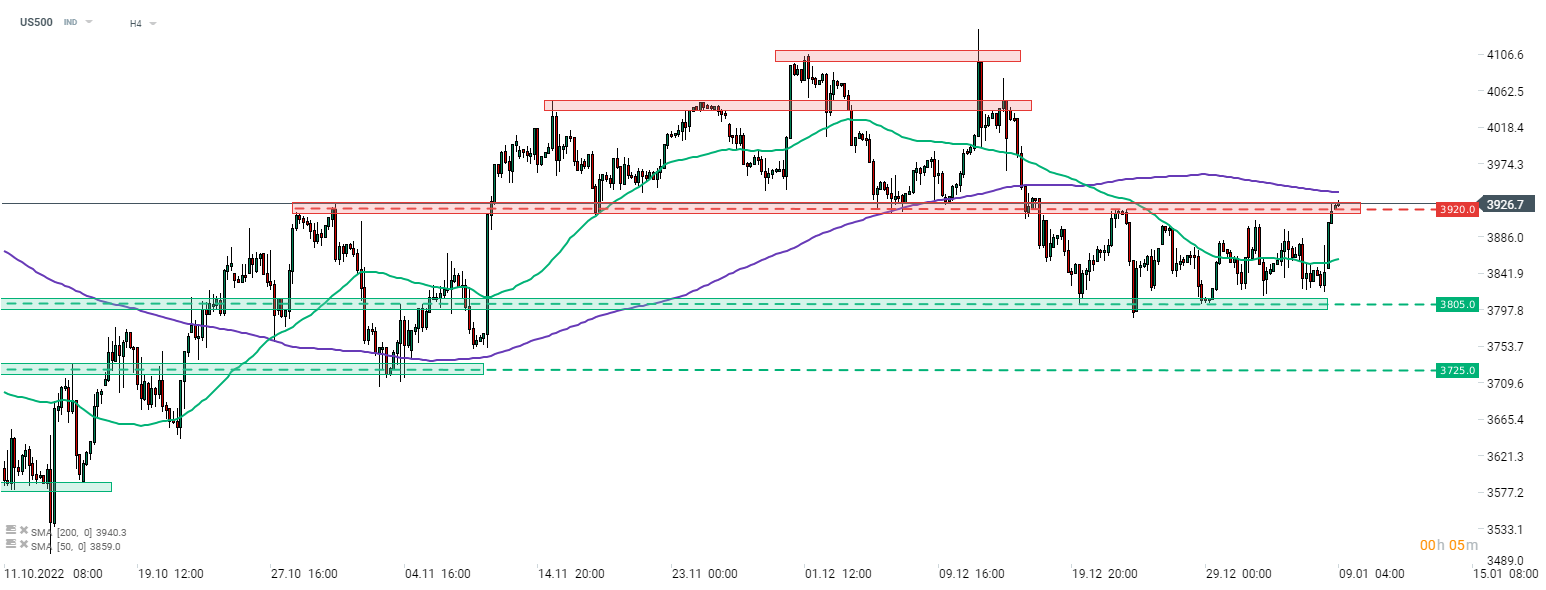

S&P500; Source: xStation5 by XTB

S&P 500 futures (US500) broke above the 3,920 resistance zone, indicating the upper limit of a short-term trading range.

The index is trading at its highest level since mid-December 2022.

“Amateur coffee fan. Travel guru. Subtly charming zombie maven. Incurable reader. Web fanatic.”

More Stories

Nicolas Loufrani: Young Londoners Design Afro Hair Emojis

US Election: Trump Vs. Harris – 2024 poll numbers in America

Börse Express – USA: Retail sales rise unexpectedly