Super battery that can store more energy than current lithium-ion batteries that can charge 80 percent in 15 minutes, with a longer life span and cheaper. Those are the big promises made by QuantumScape, the now-listed company from Silicon Valley. The solid-state battery currently being developed, if it fulfills what it promises, will be a revolution in the automotive industry, which is currently converting to electricity.

Founded in 2010 by Jagdeep Singh and Austrian Professor Fritz Prinz from Stanford University, QuantumScape has also brought billionaire Bill Gates and the Volkswagen giant on board, and after merging with investment company Kensington Capital Acquisition via SPAC, it was put up for public acquisition in 2020. ” We are pioneers in developing the next generation of solid metallic lithium batteries for use in electric cars. The company’s mission is to revolutionize energy storage to enable a sustainable future, ”that’s the message.

A short attack by Scorpion Capital

Not everyone believes this message. For example, the Scorpion Capital hedge fund, a well-known short seller. Scorpion Capital QuantumScape is posed at 188 pages long document “Pump & Dump” by and a “billions of dollars scam by Silicon Valley celebs that makes Theranos look like amateurs”. Scorpion Capital points to a blood analysis company that has been accused of widespread fraud.

Scorpion Capital now makes a number of claims against QuantumScape that make the technology difficult to question, and cites Volkswagen and QuantumScape employees themselves who are skeptical of the company. Fast charging, long service life, good low temperature performance are all just “false claims”. The Battery Company has “nice PowerPoint slides, but not much.” And the promised industrial expansion, that is, mass-production, will also not succeed. “The Quantumscape prototype is not applicable outside of the lab, even if the science is real,” she says.

As usual for short sellers, Scorpion Capital naturally has a great deal of self-interest in throwing dirt at QuantumScape. The hedge fund has bet on falling QS share prices and has had some success with the public dirt bucket campaign. The stock has decreased by ten percent. This is decent, but not dramatic compared to the other short attacks that other companies have already suffered. Finance portal Onvista writesThat Scorpion Capital had a “bad timing” in the short attack.

Quantum Scape is based on Volkswagen laboratory results

QuantumScape responded to the allegations via Twitter, rejecting them. “Just last month, Volkswagen invested another $ 100 million in the company after it was confirmed that our cells meet the technical milestones measured by Volkswagen in its own laboratories in Germany.” Is he[called[يسمى. Due to confidentiality, it is more transparent than any other company in the solid-state battery sector and will always provide details and data on current density, temperature, cycle life, cathode thickness, discharge depth, cell area and pressure are transparent – Just like here.

“As our public files made clear, we still have work to do, so this will be our last comment on this issue. We will now get back to work and continue to let the implementation speak for itself,” Quantumscape concludes.

Austria Connection from Quantum Scape is co-founder Fritz Prinz, who is at the famous Stanford University and, among other things, consulted by consultant Sebastian Curtis on a trip to Silicon Valley in order to obtain inputs for Austria’s hydrogen strategy, among other things.

Doubts earlier

Scorpion Capital isn’t the first to publicly express its doubts about QuantumScape. German technology portal Golem.de Written in late 2020Quantum Scape made a “half bogus deal” and upon closer examination, not many promises remain. Quantumscape has failed to demonstrate any significant advantage or need for its technology to build electric cars, although this is the supposed development goal. The report says the new technology will also be associated with rising costs, uncertainty and production deficiencies.

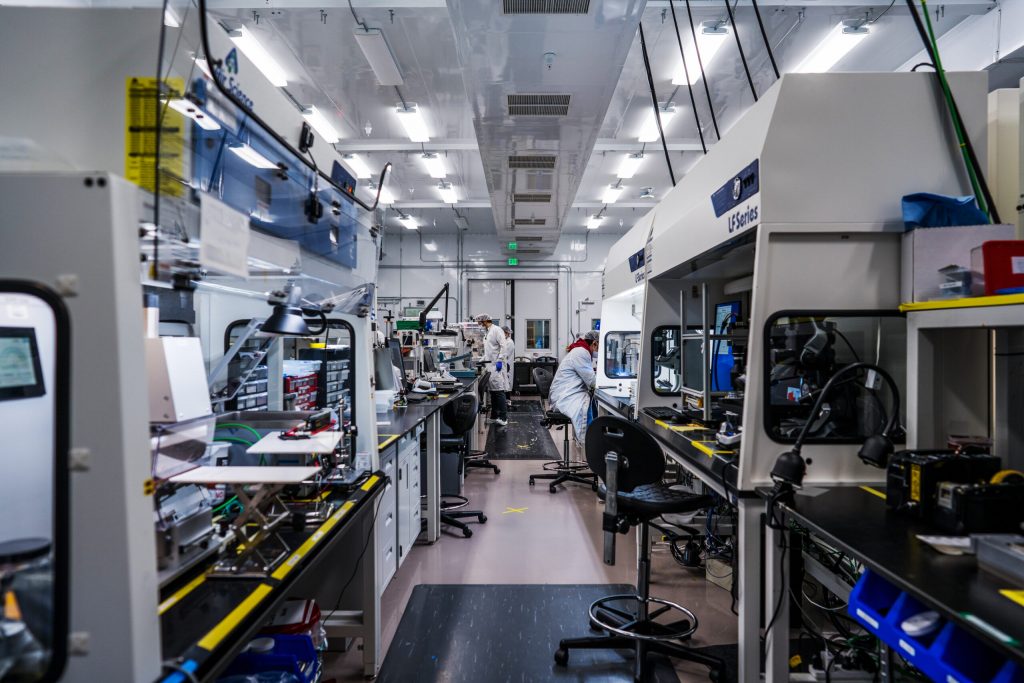

Moreover: “Scientifically, ceramic separators may be of interest to further developments. But they are not part of science because all the important details are trade secrets. It also means that QuantumScape technology can be bypassed with free search and competition at any time. , The company that has been criticized has to prove that its super battery also works outside of locked lab walls.

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

Wealthy families take more risks when it comes to money.

Salesforce and NVIDIA Form Strategic Collaboration to Drive AI Customer Innovation

Changing banks causes problems for customers