In Austria, a tourist destination, restaurants and hotels have a relatively large weight in the shopping basket, which is used to calculate the inflation rate. But this does not explain the higher inflation compared to the euro.

Vienna. The European Central Bank (ECB) is a bit hesitant about changing interest rates. The geopolitical uncertainty in the Red Sea, Europe's most important maritime trade route, is very great. In addition, there are also rising wages in many euro countries, which could lead to inflationary pressures. The European Central Bank recently left its key interest rate unchanged at 4.5% for the time being, despite declining inflation in the Eurozone.

Interest rates in Austria are still very low. Monetary authorities do not look at individual countries, but at the average in the euro area. It happens that key interest rates may be too high for some countries, but too low for others – including Austria. With inflation at 7.8%, real interest rates in this country are still negative, so monetary policy is expansionary – it creates inflationary pressures.

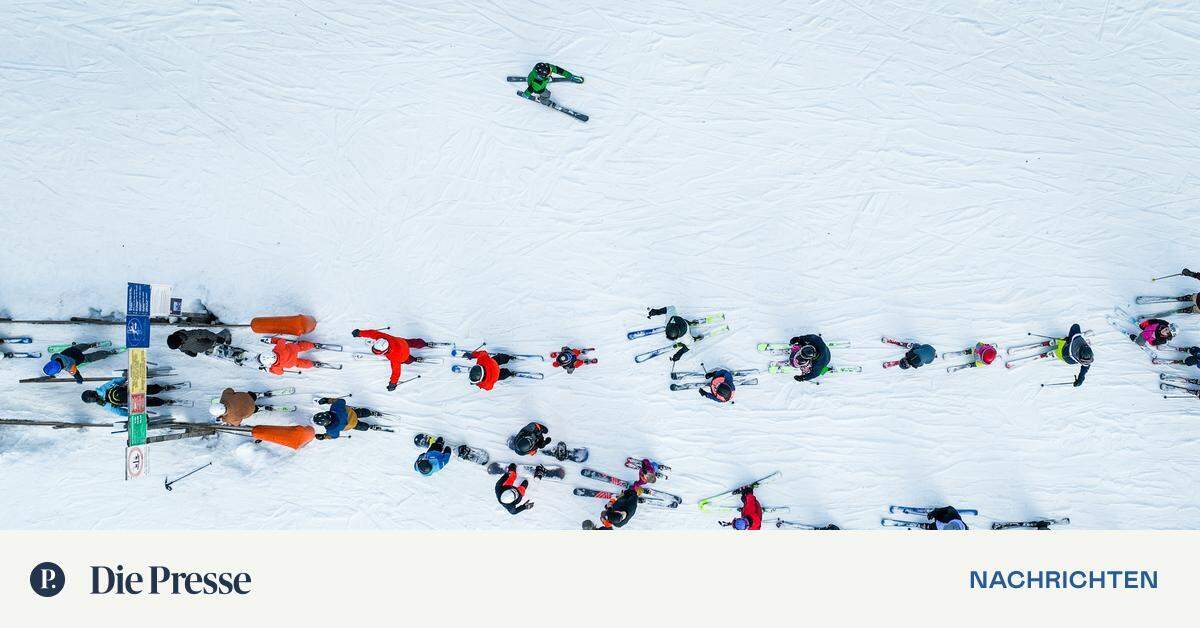

A much discussed question is why inflation in Austria is significantly higher than in the Eurozone. The most frequently sought answer is that tourist countries like Austria generally experience higher inflation because hotels and restaurants, which have become much more expensive, have more weight in the shopping basket. In fact, this country's restaurant and hotel industries are more important than the eurozone average when accounting for inflation, by more than five percentage points.

But this does not yet explain the high inflation rates, as an assessment by the economically liberal Agenda Austria program shows.

“Total coffee aficionado. Travel buff. Music ninja. Bacon nerd. Beeraholic.”

More Stories

Wealthy families take more risks when it comes to money.

Salesforce and NVIDIA Form Strategic Collaboration to Drive AI Customer Innovation

Changing banks causes problems for customers