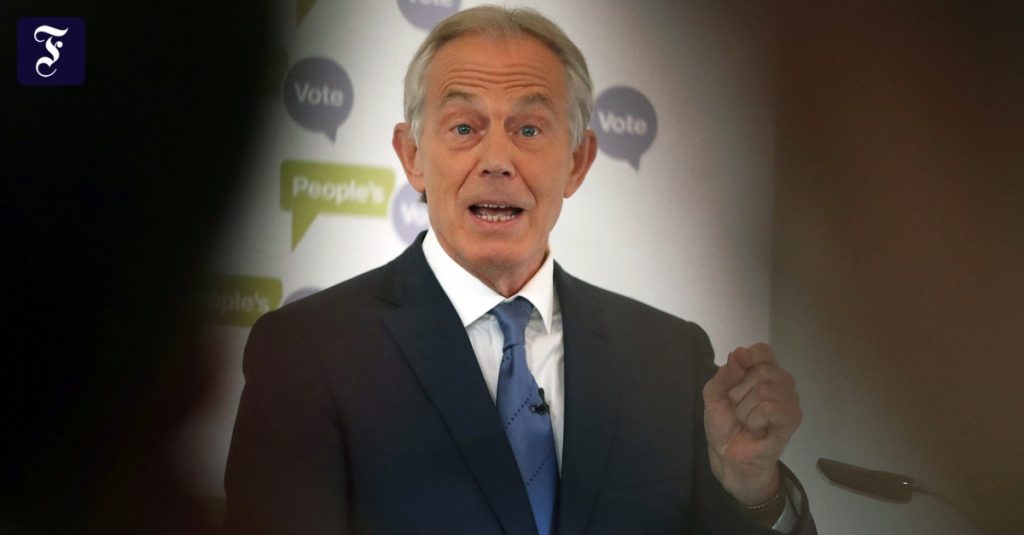

DrFormer British Prime Minister Tony Blair and his wife Cherie took advantage of a tax loophole when buying property. It is a building in London that the Blairs bought in 2017 for 6.45 million pounds (7.5 million euros today) and is now the headquarters of Cherie Blair’s law firm and services. This building was owned by an offshore company registered in the British Virgin Islands – and was bought by the Blairs.

To do this, they set up a company, as reported by the BBC, citing the so-called “Pandora’s Papers”. Since they bought such a company and not the property, there was no property transfer tax. This saved the former British Prime Minister and his wife £312,000. After the transaction was completed, the offshore company was dissolved. This is deeply embarrassing for a Labor politician, who has repeatedly criticized tax loopholes. The couple did not act illegally, the BBC confirmed.

“Pandora’s Papers” is a new edition of the International Consortium of Investigative Journalists (ICIJ). An unnamed source leaked 11.9 million documents from 14 financial service providers operating in tax havens to the organization, which were evaluated over several months by reporters in more than 100 countries. Partner media in Germany included the NDR, WDR and Süddeutsche Zeitung as well as the Washington Post, Britain’s Guardian and Le Monde from Paris.

35 current and former leaders

Cherie Blair told the BBC that her husband was not involved in the deal. The mortgage for the building was determined solely on the basis of the combined income and capital of the business. She stressed that she had put the building back under UK tax and regulation rules, and that if it was resold, capital gains tax would be paid.

“Food practitioner. Bacon guru. Infuriatingly humble zombie enthusiast. Total student.”

More Stories

Kyiv: Russian Kursk offensive halted

US Presidential Election: Former US Government Officials Warn Against Donald Trump's Election

Netherlands wants to leave asylum system