On the surface, is the US economy still relatively strong? However, in the background, a maelstrom of problems is brewing little by little. According to current Federal Reserve data, default rates on bank loans and credit card loans have continued to rise, now reaching their highest levels in 12 and 13 years.

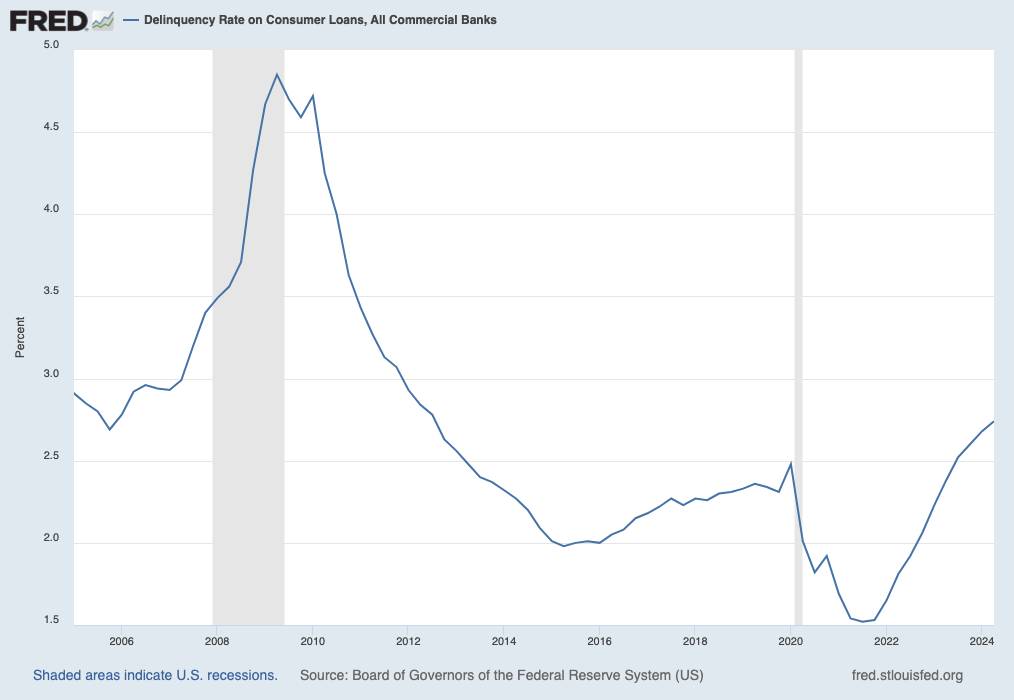

The following chart shows trends since 2005: Default rates on all consumer loans at all US banks were 2.74% at the end of June, up from 2.68% at the end of March, according to data released by the US Federal Reserve this week. At its lowest point three years ago, the default rate was 1.52%. This currently represents the highest level of debt for consumer loans in the US since 2012. At the absolute height of the financial crisis, the rate was 4.85% in 2009.

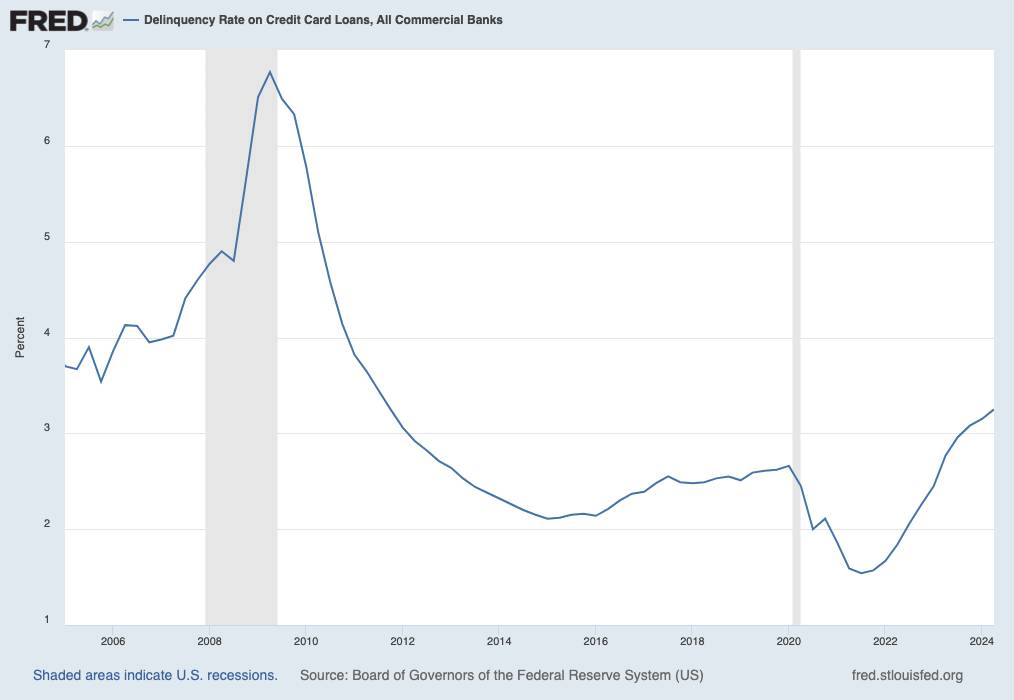

Americans are also seeing a significant increase in credit card debt. The default rate has risen to 3.25% at the end of June 2024 from 3.15% at the end of March. It was 1.54% three years ago, and 6.77% in 2009 during the financial crisis. At 3.25%, credit card defaults hit a 13-year high. In the following graphic we see the growth of default rates since 2005.

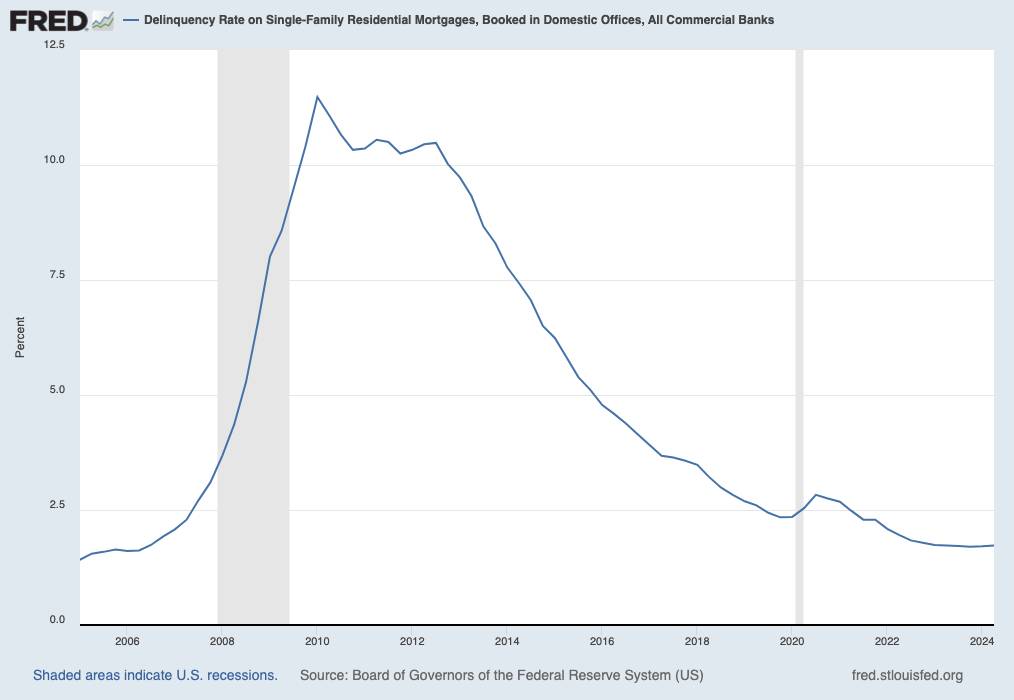

The situation is different when it comes to Americans' real estate loans for single-family homes. The default rate at the end of June was 1.73% after 1.71% at the end of March. This means the rate has remained at a consistently low level of under 2% for two years. In 2010, at the height of the financial crisis, this default rate reached 11.48%.

Data and Graphics: St. Louis Fed

“Amateur coffee fan. Travel guru. Subtly charming zombie maven. Incurable reader. Web fanatic.”

More Stories

Nicolas Loufrani: Young Londoners Design Afro Hair Emojis

US Election: Trump Vs. Harris – 2024 poll numbers in America

Börse Express – USA: Retail sales rise unexpectedly