© Reuters

© Reuters Investing.com – US financial conditions eased again in the week ended January 27.

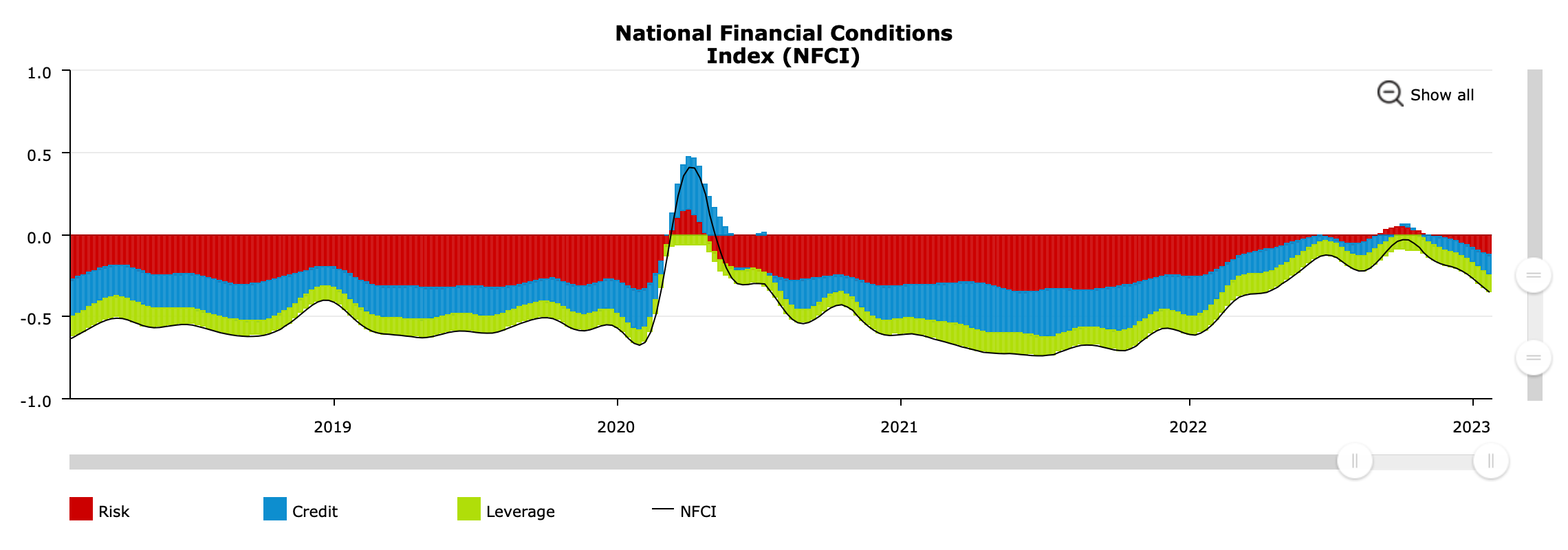

One calculated by the Chicago Fed National Financial Conditions Index, or NFCI for short, fell to its lowest level since mid-April at -0.35. Risk, credit and leverage indicators contributed to the decline by -0.12, -0.12 and -0.10 respectively, the central bank said in its weekly release.

In a historical comparison, values above zero indicate a tight financing environment. NFCI values below zero indicate a friendly financial environment. The stress index shows current conditions in the US, money and markets, and the shadow banking system.

The Federal Reserve is keen to bring financial conditions within control limits.

In the past 12 months, the bank has raised interest rates by 450 basis points to 4.50 percent and reduced its balance sheet. According to the Fed’s most recent dot plot, the federal funds rate is expected to remain above 5 percent this year. However, markets are increasingly betting on a lower final rate and rate cuts by the end of the year. That would lead to further easing of financial conditions – something the central bank does not want.

Will announce interest rate decision tonight. A 25 basis points interest rate hike is expected. That would bring the target corridor to 4.50 to 4.75 percent.

read more:

“Amateur coffee fan. Travel guru. Subtly charming zombie maven. Incurable reader. Web fanatic.”

More Stories

Nicolas Loufrani: Young Londoners Design Afro Hair Emojis

US Election: Trump Vs. Harris – 2024 poll numbers in America

Börse Express – USA: Retail sales rise unexpectedly